Maxinvest

IT Services

Scoring service in Maxinvest format – the optimal format for small microfinance organizations, credit cooperatives, insurance companies (connected the version with issuing a scoring score and issuing a recommendation of approving / refusing a loan)

The scoring service is the result of more than three years of work by Maxinvest in mutually with a number of credit organizations that have granted permission to use the data for this purpose.

The scoring service model is based on more than 200 open-sources information and alternative data sources.

Use of Credit Scoring:

Attraction of new clients

– assessment of the default possibility (loan default) of the borrower

– ranking of borrowers according to risk

– determination of the total risk per group of clients at a given level of approval

– definition of “Cut off” for a given level of risk

Monitoring the loan portfolio

– Determination of the default possibility of the borrower / group of borrowers in order to understand the future strategy of working with the Client (offering an additional loan product / increasing the credit limit, transferring to another loan product, withdrawing from the loan portfolio, etc.)

– calculation of reserves for possible losses

«Cut-off» – the score below which the applications do not pass the scoring system and, on the contrary, above which they pass.

To improve the quality of the prognosis, borrowers are segmented into homogeneous groups and for each group is their own scoring point calculation model. Segmentation is carried out on the basis of statistical analysis (CHAID analysis) in common with business logic, type of credit product, etc.

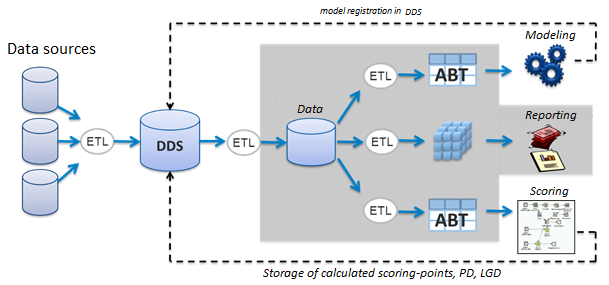

Data source / Registration of the model in DDS / Modeling / Reporting / Scoring / Data marts

Storage of accounting scoring scores, PD, LGD

ADVANTAGES OF SCORING SERVICE:

- Fast deployment and integration (within 10 business days)

- Integration with your IT environment

- The service is developed by Maxinvest data analysis specialists, that is already a guarantee of quality

- Low cost

FOR A WHAT?

For a qualitative assessment of credit risk (fraud prevention, proof of solvency and payment discipline).

To reduce costs (by reducing the number of personnel involved in the loan granting procedures)

To reduce the processing time for applications for loans (credit decision making is reduced for a few minutes)

To minimize operational risk

To analyze the reasons for low scoring assessment, and, accordingly, refusal to provide a loan (in cases of refusal)

Scoring in common with credit reports and verification of the borrower will allow you to build an effective system for making lending decisions.

FOR WHOM?

for banks

for credit unions

insurance companies

financial companies

mobile operators and telecommunications companies

other financial market participants entering into credit relations

Users can be banks, non-bank financial institutions, and other business entities that provide services with deferred payments, or provide property on credit.

A complete solution of the problem of credit scoring for banks, including functionality to support all the necessary processes. The solution includes tools for processing and storing information, building data marts, a wide range of analytical tools for building and analyzing credit scoring models and an extensive reporting system for solving the problems of assessing the performance of scoring models and the state of the loan portfolio.

The Maxinvest tools allow a data mining expert to create credit scoring models for consumer loans, credit cards, overdrafts, automotive, mortgage and other credit products. The scoring is aimed at solving various problems from assessing the probability of a client’s default to defining the strategy of the collection unit and creating a generally accepted rating model.

Contact Us

Office 4, 12/F, Emperor Group Centre, 288 Hennessey Road, Wan Chai Hong Kong, Hong Kong

© MAXINVEST LIMITED 2024. All Rights Reserved.